lv vat | l vat procedure lv vat The guide provides you with practical VAT information for Latvia: - Your VAT registration in Latvia. - Your VAT obligations TVA in Latvia. - The invoicing rules in Latvia. - A VAT credit refund in . kieran jackson and michael jones. Sun, Nov 19, 2023

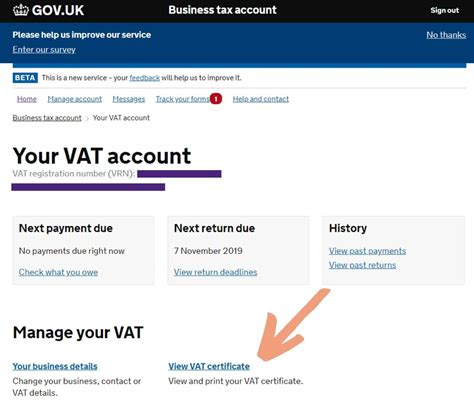

0 · vat sign in

1 · sign into my vat account

2 · log in to vat account

3 · l vats decortication

4 · l vats bullectomy

5 · l vat procedure

6 · government gateway vat registration

7 · check my vat number online

LOUIS VUITTON Official Europe site - Discover our latest Bags's Grey in For Women LV Icons collections, exclusively on en.louisvuitton.com and in Louis Vuitton Stores.

vat sign in

imsa rolex 24 hours of dayton stream

Value Added Tax (VAT) is a consumption tax, which is included in the price of goods and services and is paid by the final consumer. The standard VAT rate is 21%, but a reduced VAT rate is also set for specific groups of goods and services.Latvian VAT rates. Suppliers of goods or services VAT registered in Latvia must charge the appropriate VAT rate, and collect the tax for onward payment to the Latvian tax authorities . The relevant nation’s country code — consisting of two letters — is inserted before . Value added tax (VAT) is the consumption tax actually paid by the final consumer when purchasing goods or receiving services. VAT is neutral to entrepreneurs.

The guide provides you with practical VAT information for Latvia: - Your VAT registration in Latvia. - Your VAT obligations TVA in Latvia. - The invoicing rules in Latvia. - A VAT credit refund in .

Learn about VAT within Latvia. Find out which goods or services are liable to VAT, when to register and how to pay VAT. Get VAT news in Latvia. Our Latvia VAT guide contains all the information on Latvia's specific VAT regulations: VAT rates, VAT thresholds, obtaining a Latvian VAT number, VAT returns, VAT . VAT refund to Latvian Legal Persons in other Member States of the European Union; . +371 67120000 vid [at] vid.gov.lv Talejas iela 1, Rīga, LV-1978. E-address. Read . Below is summary of the major rules provided under Latvian VAT rules (VAT Law 2013 (Pievienotās vērtības nodokļa likums). Plus adoption of the EU VAT Directive. Check our .

In Latvia, taxpayers may apply for MOSS registration via the State Revenue Service (SRS) Electronic Declaration System (EDS) at https://eds.vid.gov.lv/login/. Appointment of a VAT .

Value Added Tax (VAT) is a consumption tax, which is included in the price of goods and services and is paid by the final consumer. The standard VAT rate is 21%, but a reduced VAT rate is also set for specific groups of goods and services.Latvian VAT rates. Suppliers of goods or services VAT registered in Latvia must charge the appropriate VAT rate, and collect the tax for onward payment to the Latvian tax authorities through a VAT filling (see Latvian VAT returns briefing).The relevant nation’s country code — consisting of two letters — is inserted before the VAT number if the company is using the number for the purposes of intra-community trade. Below is a summary of the standard formats for each EU country, .

sign into my vat account

Value added tax (VAT) is the consumption tax actually paid by the final consumer when purchasing goods or receiving services. VAT is neutral to entrepreneurs.The guide provides you with practical VAT information for Latvia: - Your VAT registration in Latvia. - Your VAT obligations TVA in Latvia. - The invoicing rules in Latvia. - A VAT credit refund in Latvia.Learn about VAT within Latvia. Find out which goods or services are liable to VAT, when to register and how to pay VAT. Get VAT news in Latvia. Our Latvia VAT guide contains all the information on Latvia's specific VAT regulations: VAT rates, VAT thresholds, obtaining a Latvian VAT number, VAT returns, VAT refunds, penalties, industry or territory specific rules, etc.

VAT refund to Latvian Legal Persons in other Member States of the European Union; . +371 67120000 vid [at] vid.gov.lv Talejas iela 1, Rīga, LV-1978. E-address. Read more; Client Services Read more; Contacts of departments Read more; Customs Customer Service Read more; Information Systems Read more;

Below is summary of the major rules provided under Latvian VAT rules (VAT Law 2013 (Pievienotās vērtības nodokļa likums). Plus adoption of the EU VAT Directive. Check our country VAT guides for other jurisdictions.In Latvia, taxpayers may apply for MOSS registration via the State Revenue Service (SRS) Electronic Declaration System (EDS) at https://eds.vid.gov.lv/login/. Appointment of a VAT Agent: The appointment of a VAT representative for VAT registration under the .

Value Added Tax (VAT) is a consumption tax, which is included in the price of goods and services and is paid by the final consumer. The standard VAT rate is 21%, but a reduced VAT rate is also set for specific groups of goods and services.Latvian VAT rates. Suppliers of goods or services VAT registered in Latvia must charge the appropriate VAT rate, and collect the tax for onward payment to the Latvian tax authorities through a VAT filling (see Latvian VAT returns briefing).The relevant nation’s country code — consisting of two letters — is inserted before the VAT number if the company is using the number for the purposes of intra-community trade. Below is a summary of the standard formats for each EU country, . Value added tax (VAT) is the consumption tax actually paid by the final consumer when purchasing goods or receiving services. VAT is neutral to entrepreneurs.

The guide provides you with practical VAT information for Latvia: - Your VAT registration in Latvia. - Your VAT obligations TVA in Latvia. - The invoicing rules in Latvia. - A VAT credit refund in Latvia.Learn about VAT within Latvia. Find out which goods or services are liable to VAT, when to register and how to pay VAT. Get VAT news in Latvia.

Our Latvia VAT guide contains all the information on Latvia's specific VAT regulations: VAT rates, VAT thresholds, obtaining a Latvian VAT number, VAT returns, VAT refunds, penalties, industry or territory specific rules, etc. VAT refund to Latvian Legal Persons in other Member States of the European Union; . +371 67120000 vid [at] vid.gov.lv Talejas iela 1, Rīga, LV-1978. E-address. Read more; Client Services Read more; Contacts of departments Read more; Customs Customer Service Read more; Information Systems Read more; Below is summary of the major rules provided under Latvian VAT rules (VAT Law 2013 (Pievienotās vērtības nodokļa likums). Plus adoption of the EU VAT Directive. Check our country VAT guides for other jurisdictions.

This organization is not BBB accredited. Security Guards in Las Vegas, NV. See BBB rating, reviews, complaints, & more.

lv vat|l vat procedure